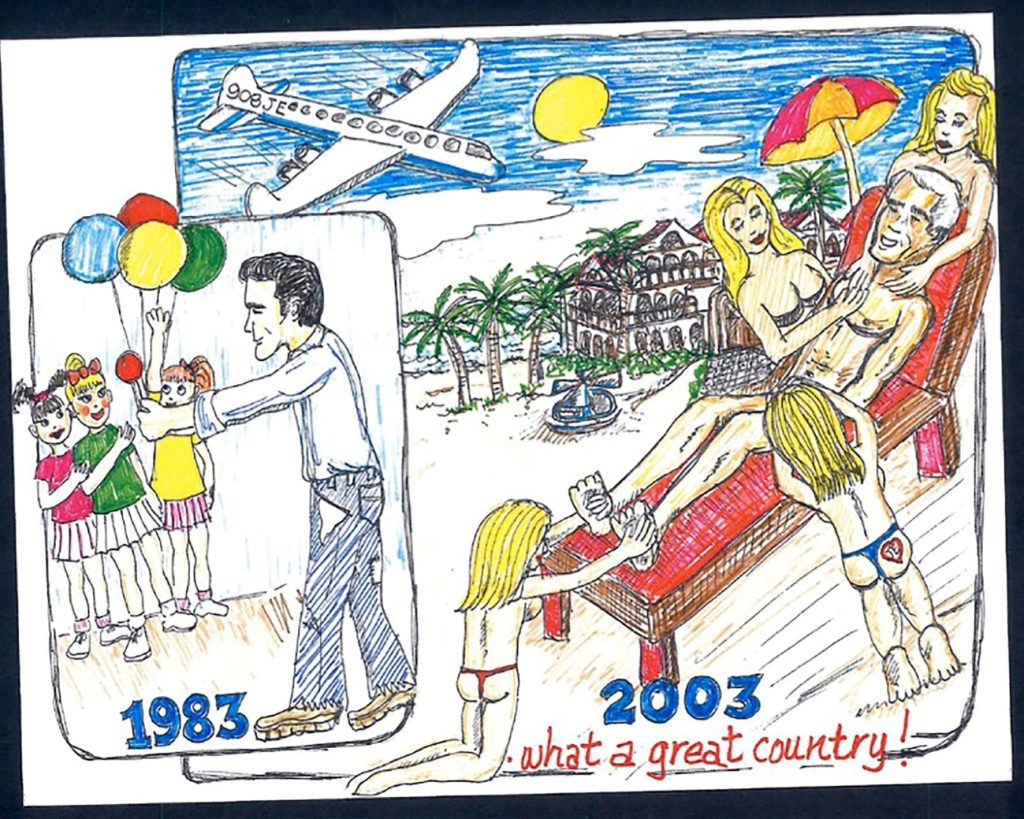

Drawing from 2003 Epstein 50th Birthday Book, released by the House Oversight Committee, September 2025. Author of drawing not identified.

IS COVER-UP OF EPSTEIN’S FINANCIAL CRIMES FINALLY COLLAPSING?

By James Bovard

In 2025, the Justice Department declared that billionaire Jeffrey “Epstein harmed over one thousand victims” – mostly young females, many of them underage. But a dozen years before his suspicious death in a New York prison cell, Epstein “was granted immunity from federal charges, as were all of his potential co-conspirators,” as the New York Times reported in July. That bizarre blanket immunity was a “get out of jail free” card for scores of men who sexually abused under-age females.

But the Trump administration announced in July that the subject was closed. Trump since then has repeatedly denounced the Epstein scandal as a “hoax,” notwithstanding the thousand victims.

Happily, neither Congress nor the media has submitted to Trump’s de facto order to “move along, nothing to see here.” The coverup of that Epstein’s financial crime network is starting to collapse. Last week, the New York Times delivered the “full story of how America’s leading lender enabled the century’s most notorious sexual predator.” JPMorgan Bank continued assisting Epstein’s crime sprees long after he pled guilty and spent time in prison for soliciting a minor for prostitution.

In 1970, Congress enacted the Bank Secrecy Act, making it a crime for banks to keep secrets from the government. Banks were required to file a federal report for any cash transaction exceeding $10,000. The IRS has devastated many small businesses for inadvertently violating that law, as I detailed on Sunday in a New York Post piece. But the law didn’t apply to the financial elite.

Epstein was pulling out $800,000 in cash each year, “much of which was used to procure girls and young women,” the Times details. Shortly after Epstein’s death in a New York prison cell, in late 2019, JPMorgan “filed a report with federal regulators that retroactively flagged as suspicious some 4,700 Epstein transactions — totaling more than $1.1 billion.” Banks are obliged to make such reports within 60 days of the suspicious activity but JPMorgan was 17 years late with some of those reports.

Those financial crime potential alerts included “hundreds of millions of dollars in payments to Russian banks and young Eastern European women” brought to the U.S., according to Sen. Ron Wyden (D-OR). But Epstein never paid a cent in penalties for the belatedly reported squirrelly dealings that would have doomed average Americans if the IRS targeted them.

Epstein used a $7.4 million transfer from his JPMorgan account “to buy a green Sikorsky helicopter to fly people to Little Saint James,” his private island in the U.S. Virgin Islands. The Times noted that JPMorgan “was supporting important cogs in Epstein’s sex-trafficking machinery. On the island, Epstein would compel teenage girls and young women to give him nude massages and have sex with him.” JPMorgan has paid more than $350 million to settle lawsuit claims from Epstein victims.

After Epstein served time for his child sex crime, JPMorgan welcomed him back and treated him like a star. JPMorgan paid him $9 million in 2011. “The fact that he remained a client in good standing conferred on him respectability and helped him foster new ties to corporate elites,” the Times noted. After his prison term, Epstein helped arrange a meeting between “JPMorgan’s investment bankers in Israel” and Bibi Netanyahu.

Rep. Thomas Massie (R-KY) is leading the push for the Epstein Files Transparency Act, a congressional edict that would compel federal agencies to speedily disclose all they have on the Jeffrey Epstein and Ghislaine Maxwell. The White House is fighting tooth-and-nail to block Massie’s resolution.

Uncovering the sources and beneficiaries of Epstein’s tainted windfalls could break the dam on the scandal. On Sept. 10, Sen. Wyden introduced the Produce Epstein Treasury Records Act (PETRA) to compel Treasury Secretary Scott Bessent to give Senate investigators the Suspicious Activity Reports tied to Epstein and his co-conspirators within 30 days. Wyden notes that those files “detail Epstein transactions totaling at least $1.5 billion dollars, and they include the names of women and girls he may have trafficked, as well as the identities of individuals whose involvement with Epstein may put them at risk of blackmail or other foreign corruption.” Wyden commented: “In this era of misinformation, these reports are the coin of the realm.”

The Trump administration is using shameless pretexts to withhold a vast trove on Epstein’s crime sprees just like the Biden administration covered up racketeering by the Biden crime family. A 2023 House Oversight Committee analysis exposed “the Biden family’s pattern of courting business in regions of the world in which the then Vice President had an outsize role and influenced U.S. policy.” The Committee asserts the Bidens and their associates “established a network of over 20 companies” that collected at least $10 million from abroad. “The Bidens took steps to hide, confuse, and conceal payments they received from foreign nationals,” the Committee reported. Banks and other entities filed 170 suspicious-activity reports tied to foreign payments the Biden family or their associates allegedly received. But the Treasury Department blocked congressional access to the Biden dirt.

Wyden, the top Democrat on the Senate Finance Committee, declared, “The basic question here is whether a bunch of rich pedophiles and Epstein accomplices are going to face any consequences for their crimes, and Scott Bessent is doing his best to make sure they won’t.” Are federal banking laws mere pretenses to empower prosecutors to punish wayward citizens as they please while letting the biggest and richest violators skate free?

The New York Times’ bombshell last week focused primarily on JPMorgan’s inside operations. Can Rep. Massie or Sen. Wyden deliver a similar blockbuster on the Epstein-related conniving in the White House, the Treasury Department, and other federal agencies? Can Congress breach the Iron Curtain that the Trump administration is perpetuating to shroud why Epstein and all his co-conspirators were given blanket federal immunity in 2007 for their sex crimes?

President Trump is paying a huge cost for refusing to honor his campaign promises to “drain the swamp” by opening the Epstein files. How many more disclosures of Trump birthday cards to Epstein and federally-protected Epstein crime waves can Trump’s credibility survive? And will disclosing the Epstein files finally explain why some U.S. politicians have scorned America’s national interest?

They all have secrets, only it’s a double standard for the wealthy. What would put a normal guy away for 15 20 and on a list is everyday life for the wealthy in their world and their is nothing anyone can do about it because of the standard of living people will 90% turn an eye for the all mighty dollar

Culture is changing as well

I am happily married 6 years now but I noticed Kip Winger and his 17 song or some movies from the last couple decades I noticed It’s not okay to be a meatball anymore. What was alright in the 80s with the ladies is taboo today. To be an older white make looking for a younger woman. It’s easy to be labeled these days. People are ready to just outright kill a pedophile make them disappear and not even report them out in the country.