New York Post, May 16, 2024

Biden takes another victory lap on inflation that Americans won’t buy

by James Bovard

On Wednesday, the latest Consumer Price Index report showed that inflation slowed slightly in April but prices continued to rise nearly 4% for the year. President Biden took his 23rd victory lap on this issue, proclaiming that “fighting inflation and lowering costs is my top economic priority.”

But how should people judge a victory proclamation by a general that had pointlessly lost 20% of his army — the amount of purchasing power the dollar has declined since he took office?

Team Biden is pretending that the nation — and Biden’s re-election campaign — has made it out of the woods.

But the Labor Department reported on Tuesday that the producer price index is rising at a rate of 6% a year, a foreboding omen of future price hikes.

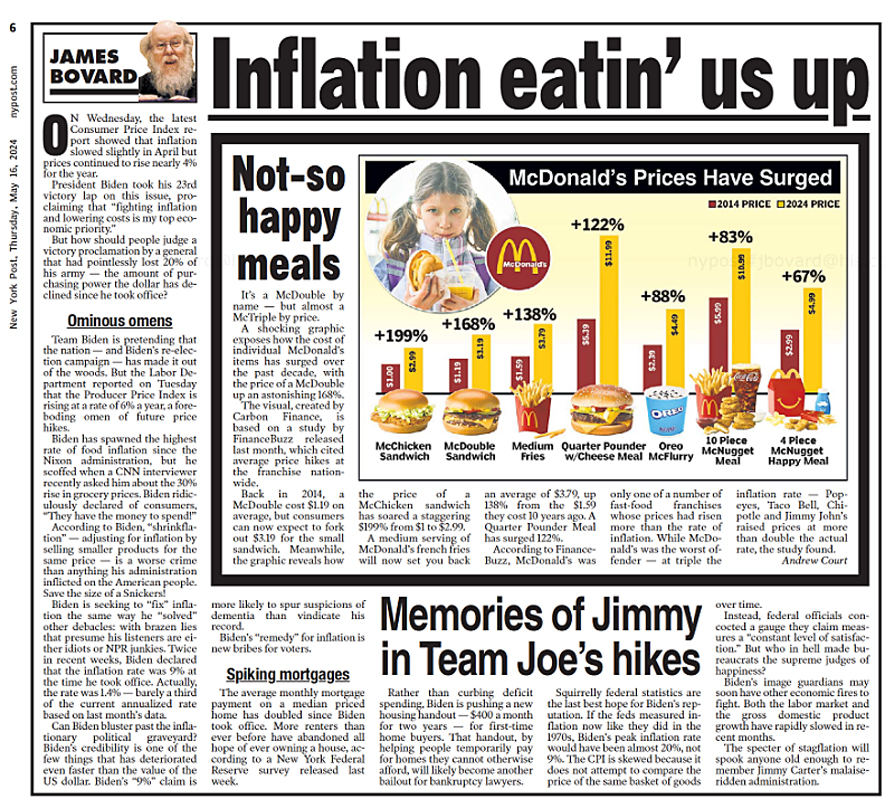

Biden has spawned the highest rate of food inflation since the Nixon administration but he scoffed when a CNN interviewer recently asked him about the 30% rise in grocery prices. Biden ridiculously declared of consumers, “They have the money to spend!”

According to Biden, “shrinkflation” — adjusting for inflation by selling smaller products for the same price — is a worse crime than anything his administration inflicted on the American people. Save the size of a Snickers!

Biden is seeking to “fix” inflation the same way he “solved” other debacles: with brazen lies that presume his listeners are either idiots or NPR junkies.

Twice in recent weeks, Biden declared that the inflation rate was 9% at the time he took office.

Actually, the rate was 1.4% — barely a third of the current annualized rate based on last month’s data.

Can Biden bluster past the inflationary political graveyard? Biden’s credibility is one of the few things that has deteriorated even faster than the value of the US dollar. Biden’s “9%” claim is more likely to spur suspicions of dementia rather than to vindicate his record.

Biden’s “remedy” for inflation is new bribes for voters. The average monthly mortgage payment on a median priced home has doubled since Biden took office. More renters than ever before have abandoned all hope of ever owning a house, according to a New York Federal Reserve survey released last week.

Rather than curbing deficit spending, Biden is pushing a new housing handout — $400 a month for two years — for first-time home buyers. That handout, by helping people temporarily pay for homes they cannot otherwise afford, will likely become another bailout for bankruptcy lawyers.

Squirrely federal statistics are the last best hope for Biden’s reputation. If the feds measured inflation now like they did in the 1970s, Biden’s peak inflation rate would have been almost 20%, not 9%. The CPI is skewed because it does not attempt to compare the price of the same basket of goods over time.

Instead, federal officials concocted a gauge they claim measures a “constant level of satisfaction.” But who in hell made bureaucrats the supreme judges of happiness?

Biden’s image guardians may soon have other economic fires to fight. Both the labor market and the gross domestic product growth have rapidly slowed in recent months.

The specter of stagflation will spook anyone old enough to remember Jimmy Carter’s malaise-ridden administration.

Comments are closed.