My Two-Bit Political Awakening

My Two-Bit Political Awakening

by

Samuel Johnson may have been wrong when he declared, “There are few ways in which a man can be more innocently employed than in getting money.” But for young kids, collecting coins is a less pernicious pastime than becoming a pyromaniac or Tik-Tok star. My own experience collecting, buying, and selling coins vaccinated me against trusting politicians long before I grew my first scruffy beard.

The thrill of coin collecting

Handling old coins was like shaking hands with the pioneers who built this country. I wondered if the dented 1853 quarter I purchased was ever involved in Huckleberry Finn–type adventures when “two bits” bought a zesty time. My grandfather gave me a battered copper two-cent piece from 1864, the same year that Union General Phil Sheridan burned down the Shenandoah Valley, where I was raised. Some of the coins I collected might now be banned as hate symbols, such as Buffalo nickels with an Indian portrait engraved on the front.

I was enthralled by early American coin designs, especially those featuring idealized female images emblazoned with the word liberty. I was unaware that George Washington refused to allow his own image on the nation’s coins because it would be too “monarchical.” Until 1909, there was an unwritten law that no portrait appear on any American coin in circulation. That changed with the 100th anniversary of the birth of Abraham Lincoln, whom the Republican Party found profitable to canonize on pennies.

By the mid-20th century, American coinage had degenerated into paeans to dead politicians. Portraits of Franklin Roosevelt, John F. Kennedy, and Dwight Eisenhower were slapped onto coins almost as soon as their pulses stopped. This reflected a sea change in values as Americans were encouraged to expect more from their leaders than from their own freedom.

When I first started collecting, I assumed that a coin’s value was largely determined by its age. That delusion was blown to smithereens at the first coin show I attended. Prices varied based on how many coins were minted each year, the popularity of different designs, and the rising number of Baby Boomers hustling to fill each slot in their blue Whitman coin folders. Coins were akin to used cars: Those with too many miles — too much visible wear and tear — traded at a sharp discount. A pristine 1950 nickel minted in Denver was worth more than a worn 1841 half dime minted in Philadelphia. Similarly, a 1931 Lincoln penny minted in San Francisco was worth more than a 1898 Indian Head penny or a 1857 large cent. Those valuations were simply supply and demand, not a sign of collective depravity.

Coin collecting as history lesson

The history of America’s coins also vivified the nation’s shifting political values. In the era of this nation’s birth, currency was often recognized as a character issue — specifically, the contemptible character of politicians. Shortly before the 1787 Constitutional Convention, George Washington warned that unsecured paper money would “ruin commerce, oppress the honest, and open the door to every species of fraud and injustice.” The Coinage Act of 1792 established gold and silver as the foundation for the nation’s currency and authorized a death penalty for anyone who debased the nation’s gold or silver coins.

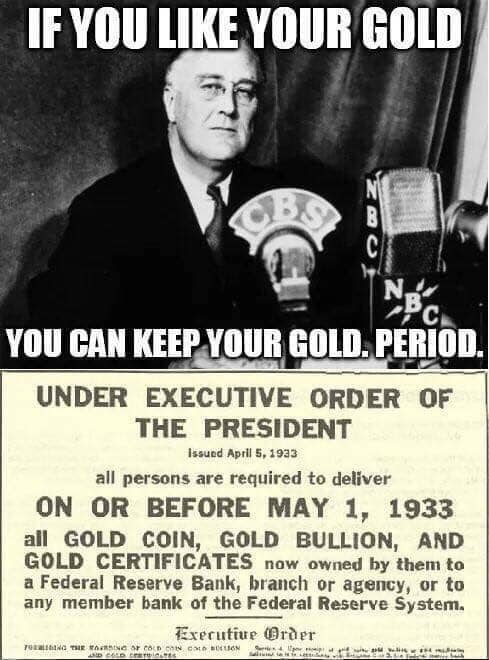

But as time passed, Americans forgot the peril of letting politicians ravage their currency. In 1933, the United States had the largest gold reserves of any nation in the world, but fear of devaluation spurred a panic, which President Franklin Roosevelt invoked to justify confiscating Americans’ privately owned gold. Roosevelt denounced anyone who refused to turn in their gold as a “hoarder” who faced 10 years in prison and a $250,000 fine. Roosevelt’s penalty was not as harsh the Soviet Union’s death penalty for anyone caught “hoarding” wheat from a collective farm. Roosevelt said he needed “freedom of action” — which he used to slash the value of the dollar from 1/20th of an ounce of gold to 1/35th of an ounce of gold.

I began collecting coins in 1965, the year President Lyndon Johnson began eliminating the silver in new dimes and quarters. At that point, the value of the dollar was falling due to federal deficit spending. The government printed new money to pay its debts, resulting in inflation. Rather than curtailing spending, Johnson debased the currency. He swore there would be no profit in “hoarding” earlier coins “for the value of their silver content.” (Silver coins subsequently increased in value 15-fold.) Johnson portrayed his debasement as progressivism at its best: “We are going to keep our eyes on the stars and our feet on the ground.” He preferred people to look skyward rather than focus on the skulduggery in Washington.

Coin dealing helped me recognize early in life that a government promise is not worth a plug nickel. From 1878 onwards, the U.S. Mint printed silver certificates redeemable for silver coins from the U.S. government. The 1935 silver certificate I purchased included this declaration: “This certifies that there is on deposit in the Treasury of the United States of America One Dollar in Silver Payable to the Bearer on Demand.” In 1964, the Treasury Department repudiated that pledge, announcing that certificates were henceforth redeemable only for silver bullion, not coins. In 1967, Congress passed the Act to Authorize Adjustments in the Amount of Outstanding Silver Certificates. Congress “adjusted” silver certificates by nullifying all further redemptions.

Shortly after my 15th birthday, the U.S. government drove the final wooden stake into the nation’s currency. In August 1971, President Richard Nixon announced that the U.S. government would cease honoring its pledge to pay gold to redeem the dollars held by foreign central banks. Nixon declared he was taking “action necessary to defend the dollar against the speculators.” But there was no way to defend the dollar against politicians. Nixon touted his default as therapy for his tormented fellow citizens, promising it would “help us snap out of the self-doubt, the self-disparagement that saps our energy and erodes our confidence in ourselves.” Nixon wrapped his decree with lofty political rhetoric, appealing to the nation’s “greatest ideals” and promising a “new prosperity” that “befits a great people.” And for Nixon, mass gullibility was the clearest proof of a “great people.” Nixon’s gold default was a milestone in America’s rising economic and political illiteracy.

The dollar thus became a fiat currency — something which possessed value solely because politicians said so. Nixon spurred the Federal Reserve to create an artificial boom to boost his reelection campaign. To suppress the damage from a flood of new money, he imposed wage and price controls, making it a crime to raise prices without government permission.

At the time, I was toiling in a peach orchard 10 hours a day, reaping $1.40 an hour and all the peach fuzz I could take home on my arms and neck. Nixon’s wage controls doomed any chance of getting that raise to $1.45 an hour. But no loss — I was leaving that job soon to go back to high school.

Coin collecting as an investment

Reading Coin News and other numismatic publications, I soaked up the rage at how the U.S. government was intentionally torpedoing the value of the dollar. I had not yet read economists like Friedrich Hayek, Milton Friedman, or Adam Smith, but my gut sense told me something was profoundly amiss. I shifted from collecting to investing, pouring most of the money from the jobs I did during high school into rare coins. Because rare coins were appreciating almost across-the-board, it was difficult not to be lucky in one’s choices.

After graduating high school in 1974, I began working a construction job. When I got laid off, I saw it as a sign from God (or at least from the market) to buy gold. Investment newsletters and political debacles convinced me the dollar was heading for a crash. I liquidated most of my coin collection and put all my available cash into gold. I also took out a consumer finance loan at 18 percent to purchase even more. That interest rate was the gauge of my blind confidence. Nixon’s resignation in August 1974 did wonders to redeem my gamble.

I didn’t get rich but made enough to help pay for sporadically attending Virginia Tech, with some money left over to cover living expenses during my first literary strikeouts. Though Nixon assured the nation in 1971 that axing the gold standard would “stabilize the dollar,” inflation quadrupled between 1972 and 1974. If the government would intentionally destroy the value of the currency, I wondered what else it was undermining.

My next foray into the gold market came after I moved to Boston to try my luck as a writer. Among the zany ladies I dated there was a woman of mixed Catholic and Jewish parentage who felt guilty about everything except drug dealing. After the relationship with Melanie mellowed into a friendship, she confided that she was afflicted by surplus cash. I invested her marijuana proceeds in Kruggerands (South African gold coins), and we split the profits after the price of gold soared in the late 1970s. If I had provided the same investment assistance after Reagan launched the drug war, the feds could have accused me of money laundering and confiscated everything I owned — even my old reliable Smith-Corona typewriter.

I eventually blundered into journalism and descended to the Washington area. Two weeks after I moved into a shabby group house in the District of Columbia in 1983, I pawned the last gem of my coin collection — the 1885 five-dollar gold piece that my Irish American grandmother had given me 15 years earlier. She was a dear sweet lady who would have appreciated that her gift helped cover the rent for a few more weeks until I finally, consistently hit solid paydirt later that year. (Thanks, Reader’s Digest!)

Coin collecting as an economics lesson

My coin-dealing experiences helped inoculate me against Beltway-style agoraphobia — a pathological dread of any unregulated market. I had a visceral hostility to political price-fixing long before I understood the economic theory. I knew that the test of a fair price is the voluntary consent of each party to the bargain, “the free will which constitutes fair exchanges,” as Senator John Taylor wrote in 1822. Presidents and Congress “fixed” prices according to political pull, not according to some vaporous, ever-changing vision of social justice. Nixon boosted the price of milk after the dairy lobby pledged $2 million in illegal contributions to his 1972 reelection campaign. Politicians perennially drove U.S. sugar prices to triple the world sugar price in response to kickbacks from sugar growers. It was nuts to permit politicians to control prices when there was no way to control politicians. Recognizing that economic value was subjective was a Rosetta Stone for my attacks on federal trade and agriculture policies in the following years.

For almost a century, American coinage and currency policies have veered between “government as a damn rascal” and “government as a village idiot.” The dollar has lost 85 percent of its purchasing power since Nixon closed the gold window. I remain mystified how anyone continues trusting politicians after the government formally repudiates its promises. But I still appreciate old coins with beautiful designs that incarnated the American creed that no one has a right to be enshrined above anyone else.

This article was originally published in the December 2021 edition of Future of Freedom.

You’re about eight years younger than I am, and we started collecting coins at about the same age. I lucked out in ’57, ahead of the big collecting craze following the penny change in ’59. My brother and I found every Lincoln date except 1909s-vdb and 1914d just by going thru rolls of coins. Even found a couple of Indian head pennies. By 1960 you’d be lucky to find anything prior to the ’40’s: they’d pretty well been sucked out of circulation.

Yes to every point you make about the idolatry of imagery and worthlessness of today’s coins. Even copper is too valuable to use in them now, or rather they’re so worthless they can’t even be made out of copper.

Some very good lines that made me laugh out loud (“felt guilty about everything except drug dealing”, government veering between damn rascal and village idiot, etc.).

Glad you got into coin collecting before the 1960s frenzy.

I appreciate that you liked my fav lines in the piece – I always hope that they will resonate with folks who read the pieces. (My hunch is that lines don’t work as well with folks who skim pieces on cell phones.)